The following is apparently an open letter from Merrill Lynch's head of research.

March 22, 2007

Dear Client,

Not long ago, something very disturbing happened to me while I was sitting at my desk listening to our morning call. That morning, we featured a contrarian upgrade of a major U.S. company's common stock - which went on to generate over a 40 percent return for our clients. What happened was that within 60 seconds of releasing our opinion change, this same information we had just sent out on our private platforms was being replicated with plagiaristic precision by a New Jersey-based digital financial news source. This is a website that purports to provide its paying customers with research it compares to "having a seat at Wall Street's best houses and learning what they know when they know it."

The heart and soul of what sell-side analysts do is to provide well-grounded investment ideas to individual and institutional clients to support them in making timely and (we hope) profitable investment decisions. But that day I realized that, much like the music and film industries before us, Merrill Lynch Research is in the throes of being Napsterized. I also realized that like every other content provider - from the Walt Disney Company to obscure news outlets - Merrill Lynch Research needed to regain control of our distribution channels in order to preserve and protect our hard-earned intellectual capital for you.

So, starting this month, we have begun to take a number of aggressive steps to ensure that we can continue to provide premium products and services for the exclusive use of our clients. We are rolling out a digital distribution strategy that 1) terminates research access to non-clients on our proprietary site and external vendor platforms; 2) further restricts and delays media access to selected content; 3) eliminates existing licensing arrangements that erode the value of our written product and 4) establishes licensing agreements at market prices competitive with services offered by other providers.

For a number of years, I have been listening with mounting frustration to a never-ending litany of statements that erroneously predict the demise of sell-side research, labeling it as virtually without value in the digital era. Certainly the ease and speed with which the fruits of our efforts can be posted on the web for the world to review has pointed yet another arrow at the chests of sell-side research organizations. Yet, when I listen to these predictions, I feel like Tom Sawyer covertly present at his own funeral: perversely proud to be there while basking in an inviolable certainty that sell-side research is alive and well.

Sell-side research is not only surviving but thriving in today's global marketplace, because it plays a critical role in ensuring that corporate, fixed income and other securities are priced as fairly as possible in the primary and secondary markets, thereby delivering one of the most important functional elements of a market economy: efficient capital allocation. Sell-side research turns information into insight - both in the form of investor education and specific recommended investment ideas. Merrill Lynch currently employs 750 analysts who follow more than 3,000 stocks and other securities for institutional and individual clients. The educational value and investment recommendations produced by those analysts is not only broad, it is exceedingly valuable: Last year, our recommendations produced a total global return (calculated in local currency) of 19.5% versus the MSCI's 16.2%.

Fortunately, clients grasp the value of sell-side research. According to a recent poll of more than 2,000 institutional clients by Greenwich Associates, U.S. respondents reported that they effectively allocated nearly half (42%) of their total commission spend on high-quality sell- side ideas. And, the much-bandied-about notion that hedge funds value research less than other money management firms is further contradicted by the same poll's finding that U.S. hedge funds allocate 55% of their commissions for research, as opposed to 33% at mutual funds.

There is little doubt that sell-side research continues to be highly valued by those in the know, yet at the same time it is incumbent upon us to nimbly adjust to the ever-shifting exigencies of the digital era. By continuing to deliver alpha and eliminating access to research by non-clients, we can and will regain the recognition that the sell-side research profession deserves, and we will also better serve you.

Sincerely,

Candice Browning

SVP, Head of Global Securities Research & Economics

Merrill Lynch

Being a sell side analyst, I can understand why he feels this way. Not that I agree, but what I do object to is the word "Napsterized". Napster was a revolution that challenged the monopoly of the big bad record labels! Yes, they had it castrated, but that doesn't mean it was a bad thing. I loved it when it was there - techies of the day spoke about it with awe and wonder. Now its a bad word???

March 22, 2007

Dear Client,

Not long ago, something very disturbing happened to me while I was sitting at my desk listening to our morning call. That morning, we featured a contrarian upgrade of a major U.S. company's common stock - which went on to generate over a 40 percent return for our clients. What happened was that within 60 seconds of releasing our opinion change, this same information we had just sent out on our private platforms was being replicated with plagiaristic precision by a New Jersey-based digital financial news source. This is a website that purports to provide its paying customers with research it compares to "having a seat at Wall Street's best houses and learning what they know when they know it."

The heart and soul of what sell-side analysts do is to provide well-grounded investment ideas to individual and institutional clients to support them in making timely and (we hope) profitable investment decisions. But that day I realized that, much like the music and film industries before us, Merrill Lynch Research is in the throes of being Napsterized. I also realized that like every other content provider - from the Walt Disney Company to obscure news outlets - Merrill Lynch Research needed to regain control of our distribution channels in order to preserve and protect our hard-earned intellectual capital for you.

So, starting this month, we have begun to take a number of aggressive steps to ensure that we can continue to provide premium products and services for the exclusive use of our clients. We are rolling out a digital distribution strategy that 1) terminates research access to non-clients on our proprietary site and external vendor platforms; 2) further restricts and delays media access to selected content; 3) eliminates existing licensing arrangements that erode the value of our written product and 4) establishes licensing agreements at market prices competitive with services offered by other providers.

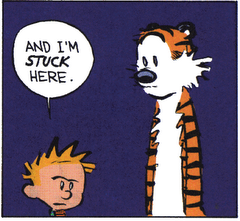

For a number of years, I have been listening with mounting frustration to a never-ending litany of statements that erroneously predict the demise of sell-side research, labeling it as virtually without value in the digital era. Certainly the ease and speed with which the fruits of our efforts can be posted on the web for the world to review has pointed yet another arrow at the chests of sell-side research organizations. Yet, when I listen to these predictions, I feel like Tom Sawyer covertly present at his own funeral: perversely proud to be there while basking in an inviolable certainty that sell-side research is alive and well.

Sell-side research is not only surviving but thriving in today's global marketplace, because it plays a critical role in ensuring that corporate, fixed income and other securities are priced as fairly as possible in the primary and secondary markets, thereby delivering one of the most important functional elements of a market economy: efficient capital allocation. Sell-side research turns information into insight - both in the form of investor education and specific recommended investment ideas. Merrill Lynch currently employs 750 analysts who follow more than 3,000 stocks and other securities for institutional and individual clients. The educational value and investment recommendations produced by those analysts is not only broad, it is exceedingly valuable: Last year, our recommendations produced a total global return (calculated in local currency) of 19.5% versus the MSCI's 16.2%.

Fortunately, clients grasp the value of sell-side research. According to a recent poll of more than 2,000 institutional clients by Greenwich Associates, U.S. respondents reported that they effectively allocated nearly half (42%) of their total commission spend on high-quality sell- side ideas. And, the much-bandied-about notion that hedge funds value research less than other money management firms is further contradicted by the same poll's finding that U.S. hedge funds allocate 55% of their commissions for research, as opposed to 33% at mutual funds.

There is little doubt that sell-side research continues to be highly valued by those in the know, yet at the same time it is incumbent upon us to nimbly adjust to the ever-shifting exigencies of the digital era. By continuing to deliver alpha and eliminating access to research by non-clients, we can and will regain the recognition that the sell-side research profession deserves, and we will also better serve you.

Sincerely,

Candice Browning

SVP, Head of Global Securities Research & Economics

Merrill Lynch

Being a sell side analyst, I can understand why he feels this way. Not that I agree, but what I do object to is the word "Napsterized". Napster was a revolution that challenged the monopoly of the big bad record labels! Yes, they had it castrated, but that doesn't mean it was a bad thing. I loved it when it was there - techies of the day spoke about it with awe and wonder. Now its a bad word???

No comments:

Post a Comment